30/05/2014

A few distribution sheds in Essex and east London seem like very small beer in the context of a global business with $4.3 trillion of assets under management. That has not prevented BlackRock from contributing to the gathering momentum in the speculative shed development market.

Last month, the world’s largest investment manager announced that it would back warehouse schemes in West Thurrock and Chingford. Justin Brown, managing director and portfolio manager for the BlackRock UK Property Fund, says it has its sights on further acquisitions.

BlackRock, which was founded in the US in 1988 by chairman and chief executive Larry Fink, made $756m profit in the first quarter of 2014. It has grown at an exponential rate, frequently through acquisitions. It was a merger with Merrill Lynch Investment Managers that gave the company a substantial presence in the UK real estate market.

It took control of Merrill Lynch’s UK property fund, which has since expanded to manage more than £2.7bn of assets in a variety of sectors including the industrial market, making it the largest fund in the IPD index of all balanced funds.

The fund is usually described as a “core” investor, favouring low-risk, low-yielding assets compared with a fund with an “opportunistic” strategy.

“I hate the word core,” says Brown. “Sometimes, it has this connotation of being rather dry and lifeless, or limp. I accept that we are core, but what we are trying to do within that construct is add value. We invest in industrial, office and retail across the UK, but compared with our competitors, the fund also has a significant investment in alternative parts of the real estate market such as doctors’ surgeries, a marina business and, most recently, in student housing.”

“You tend to get higher income returns from industrial than you do in the retail or office sectors.”

Justin Brown, managing director, BlackRock UK Property Fund

Brown joined the firm in July 2012 from UBS Global Asset Management, where he managed its Triton property fund for five years. Before that, Brown spent 10 years at LaSalle Investment Management. The BlackRock UK Property Fund is an open-ended Jersey-based unit trust. Most of its equity investors are small to medium-sized UK pension funds.

“Industrial is about 17% of the total fund. It is a weighting that has increased over the past 18 months,” says Brown. “You tend to get higher income returns from industrial than you do in the retail or office sectors, and the structural changes in terms of consumers’ behaviour – buying more of the things that they want to buy online – lends itself to distribution warehouses.”

In April, BlackRock backed development partner Bericote to begin construction of three speculative sheds totalling about 275,000 sq ft at Tower Thurrock in West Thurrock, Essex. In the same month, it acquired the Circular Point site in Chingford, east London, agreeing to forward-fund speculative development of a 100,000 sq ft trade counter and warehouse scheme built by former owners Wrenbridge and Palmer Capital Partners.

At Tower Thurrock, BlackRock had been seeking a prelet for a larger building. Bericote, however, advised a change of strategy to the speculative construction of slightly smaller warehouses. Brown explains why BlackRock agreed to the suggestion: “We have just got a little more confidence the UK economy is stronger and the dearth of new supply and slightly better tenant market mean we hope to do pretty well with these.”

Another factor was the increase in prices paid for industrial property, which is prompting a return to speculative development in the UK sheds market (see box). Brown says: “With the inward yield shift, we have seen in industrial and distribution over the past 15 months if you develop these buildings and lease them, the yield on development cost is an awful lot more attractive than the yield which we would be able to buy at in the investment market. So we feel that this is a risk that is worth taking.”

The risk is also reduced by the short time that it takes to construct an industrial building after securing planning permission, compared with that for offices. “It takes six to nine months to reach the market,” says Brown.

“That is a relatively short period of time in which to underwrite the economic direction of the country. West Thurrock will be about 0.6% of our total net asset value, so we are not betting the house on this. We are taking that risk within the context of a very large portfolio.”

BlackRock owns one other notable development site in the South East, Bedfont Industrial Estate near Heathrow Airport, which it bought from Trehaven Group last August for £24m. Open storage uses provide the investor with an income while it tweaks the existing planning permission for 300,000 sq ft of industrial space. “It will be pretty similar to West Thurrock: distribution but not one big unit – maybe a cluster of three or four buildings,” says Brown.

However, he is unwilling to commit to speculative development until planning permission is secured.

The fund will continue to acquire industrial property in proportion to its overall size by purchasing multi-let industrial estates and developing distribution sites. Funding for speculative development has been confined to the South East, but BlackRock will consider other locations.

“We are open to other opportunities, but we are underwriting with a great deal of discipline,” adds Brown. “The Midlands market is one in which we would like to get a holding if we could.”

It takes a lot of properties, shares and bonds to make up $4.3 trillion of assets. So every little helps.

Playing the yield

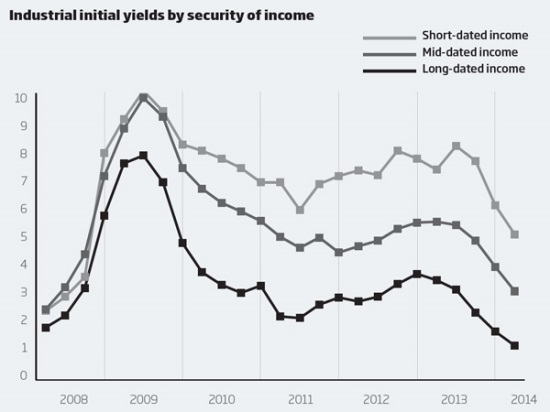

Returning economic confidence is helping to drive investor interest in the sheds market, pushing prices up and encouraging a return to speculative development.

Richard Moffitt, head of industrial investment at CBRE, says: “The yield shift in the past 12 months for prime industrial property is getting on for 75 basis points [0.75%], and as yields come in, you suddenly reach the point when speculative development makes sense. There will be significant speculative development over the next year, looking to capture pent-up demand.”

Moffitt says that with returns of less than 6% achievable on standing investments, but more than 8% for speculative development, the greater return justifies the additional risk.

He does not envisage any danger of the market overheating at present, however, as there is a good balance between the investment market, which is prepared to pay high prices in expectation of rental growth, and the occupational market, where there are few buildings on the market in prime locations and a gradual return of demand.

Philip Marsden, head of industrial investment at Jones Lang LaSalle, predicts: “There is a little more yield compression to come. You can still get a yield of 6% on an industrial estate in London and next to nothing in the bank [because of low interest rates].”

Marsden expects an increase in the amount of industrial property traded over the coming months. “There are a lot of funds, joint ventures and vehicles established and looking for industrial property – Legal & General’s industrial fund wants to buy more. Then there are a number of people who are prepared to exit the market and take the profit,” he says.

Like Moffitt, he predicts a return of speculative development: “A number of investors are doing speculative funding,” he says. “I don’t think there will be a huge amount though. A lot of people got pretty badly burned the last time.”

Industrial yields

By Stuart Watson